Supercharge your Analytics, Amplify Business Impact.

Easy-to-use, automated, cloud-based ERP analytics designed for Industrial Manufacturers.

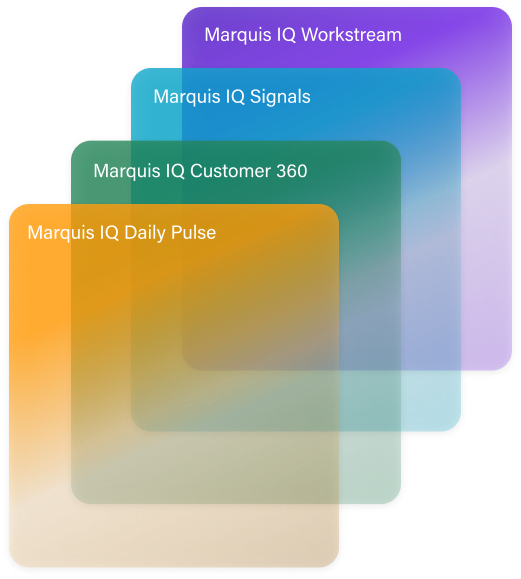

Marquis IQ Analytics Suite with business best practices built-in:

Lightning-fast implementation, real-time reporting, deeply connected data and insights, all from 1 easily accessible location.

Marquis IQ is intelligent, model-driven analytics – specifically developed to help business leaders access and act upon their data.

We turn your goals into easy-to-use visualizations that foster confident decision-making across your organization and keep everyone on track. Using our Marquis IQ models, we create real-time signals to keep you in tune with the state of your business – automatically.

Prepare to elevate your intelligence with Marquis IQ.

Rapid deployment with certified connectors. Start making a difference in just days – rather than months.

Marquis IQ represents the future of data-enablement technology. We’re putting it in your hands today.

Our Marquis IQ industry solutions builds on over 20 years of industrial data and real-world manufacturing experience and delivers impact immediately.

Get the Business Solution that Matches your Need

We’ve spent years cultivating expertise and compiling industry knowledge into a group of standard analytics models that really deliver. Outcome- oriented and activity-specific, Marquis IQ models are the brains of the operation – and their power is proven.

Marquis IQ Daily Pulse

Monitor your company’s performance daily from a single place – your “daily pulse”. Delivered directly to your inbox each morning or available interactively anytime, you’ll stay on top of everything with ease.

Marquis IQ Customer 360

Know your customer like never before. See every interaction with your customer in a single place for unprecedented insight. Remain up- to-date on everything from orders, service calls, shipments, and more in a single simple view.

Marquis IQ Signals

Stop trying to manage your business or teams in Excel and automate. Detect needed actions within your data, and assign and triage seamlessly. Transform how your organization detects opportunities and drives action – using data.

Marquis IQ Workstream

Connected Enterprise Apps

Subscription includes up to the max number of connected systems.

Cloud Database Hosting

We provide Microsoft Azure SQL Server base tier at no cost; DTU upgrade priced per request to scale and improve performance when you need it.

3 Year Price Lock

Lock in today’s subscription and professional services prices by agreeing to a 3-year term.

Essentials

Table-stakes in

analytics.

INCLUDES

Subscription includes up to the max number of connected systems.

Subscription includes up to the max number of connected systems.

1-3 Connected Systems

Standard

Connect more data,

deeper discounts on

Business Solutions Packs

INCLUDES

Subscription includes up to the max number of connected systems.

We provide Microsoft Azure SQL Server base tier at no cost; DTU upgrade priced per request to scale and improve performance when you need it.

Lock in today’s subscription and professional services prices by agreeing to a 3-year term.

4-6 Connected Systems

Premier

Enterprise data for business leaders

INCLUDES

Subscription includes up to the max number of connected systems.

We provide Microsoft Azure SQL Server base tier at no cost; DTU upgrade priced per request to scale and improve performance when you need it.

Lock in today’s subscription and professional services prices by agreeing to a 3-year term.

10+ Call for special pricing

Connect Data

ERP’s, CRM’s, Excel Worksheets, Data Outputs. We collect and connect your data.

Clean Data

We help you clean your data and business processes to eliminate waste, noise, and inaccurate outputs.

Automation

Automate workflows that were once tedious or took time with manual processes. Integrate your data across your business, into your workstreams, and let it make your strategy setting, course correcting, and profit building job easier.

Dashboards & Alerts

Dashboards and alerts proactively monitor the health of your business. Put your data to work in simple-to-understand dashboards and get alerts delivered on-demand.

Data Culture

Coach your teams. Train your teams. Create a data culture that sticks – not because it’s a fad – but because it improves performance and improves business.

The Company we Keep

We have the pleasure of working with some of the world’s most innovative and driven companies. Join the family.

Unmistakably Marquis

We’ve got the kind of hands-on experience that you can’t learn unless you’re living it. The kind of experience that keeps us at the forefront of the analytics game – often making us the first to set industry benchmarks and develop new best practices.

Let us help you level up your business, whether you’re in need of our Marquis IQ Technology Stack, or our business analytics experts.